Loans

With Loans module you can manage all your debt interest rate products such as intercompany loans, bonds, and money market loans and deposits such as commercial papers.

Create Loan

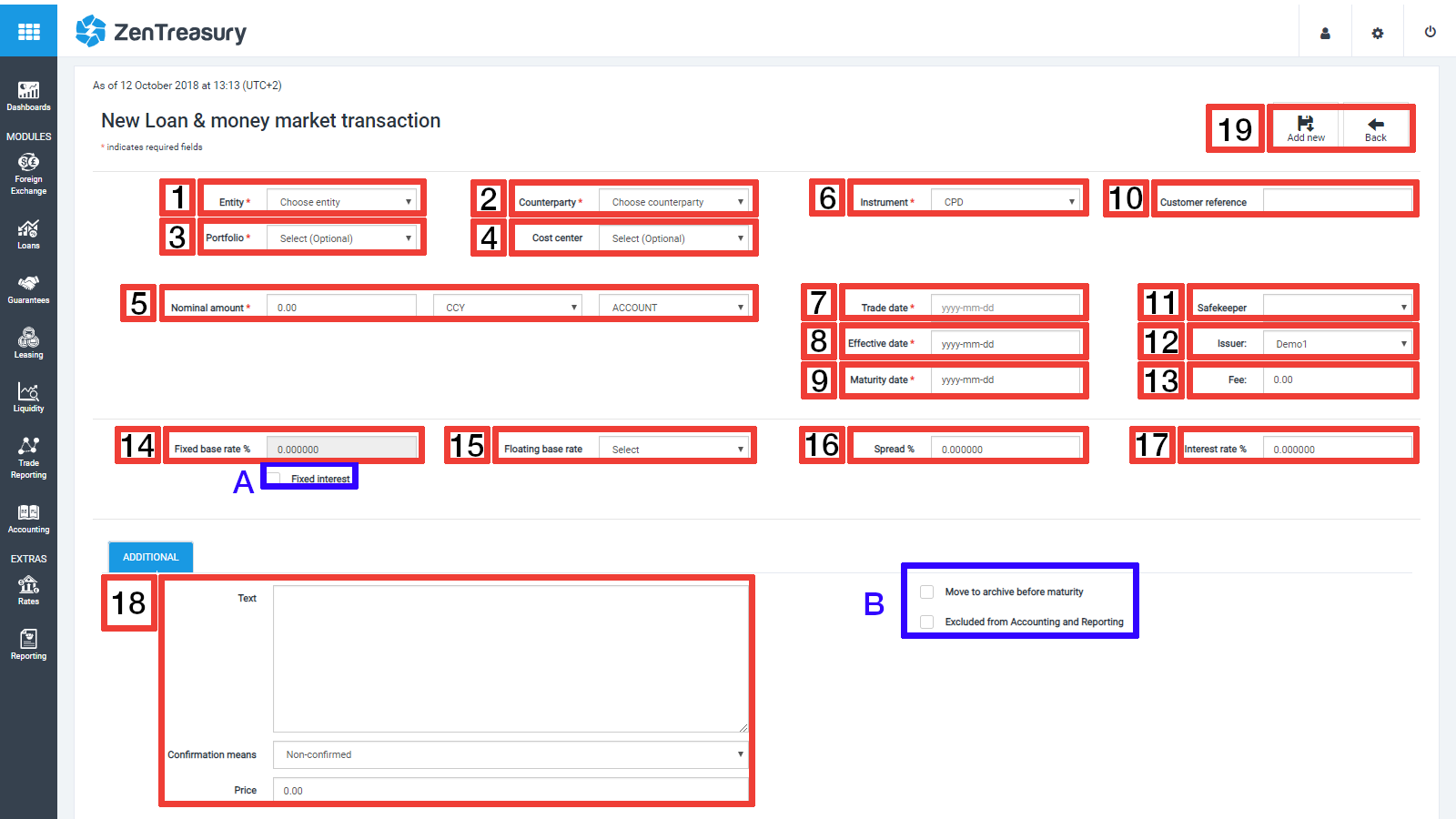

You must have create the relevant Entity, Counterparty, Portfolio and Bank Accounts to proceed with creating New Loan and Money Market Transactions.

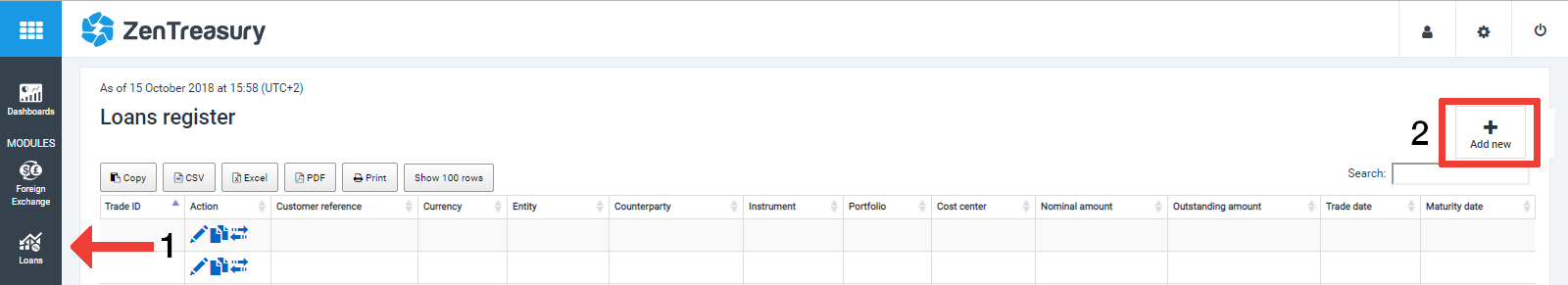

Click on (1) Loans > Register.

Click (2) 'Add new'.

1) Choose from the Entity dropdown list the company from whos point the loan is done.

2) Select the counterparty from the Counterparty dropdown list.

3) The Portfolio helps to categorise your data in reports. (New portfolios can be created under Settings > Portfolios).

4) The Cost center helps to categorise your data in reports. (New Cost centers can be created under Settings > Cost center).

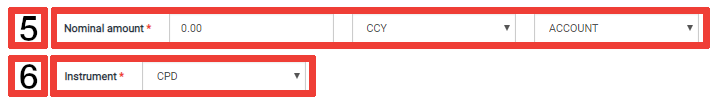

5) Enter transaction amount in the Nominal Account box.

- Choose the Currency (CCY).

- Choose the default account that will be used for the first cash flow from the ACCOUNT dropdown list. You can always change the account for future dealflows.

6) Choose the Instrument from the dropdown menu. You can define your own Instruments from Loans -> Instruments view.

7) Choose the Trade date from the calendar.

8) Choose the Effective date from the calendar.

9) Choose the Maturity date from the calendar.

10) Enter customer reference in the Customer Reference box. This is a reference that you can use to identify the transaction.

Optional 11, 12 and 13) Safekeeper, Issuer dropdowns and Fee field aren't currently used. They will be used when we add counterparty risk mgmt.

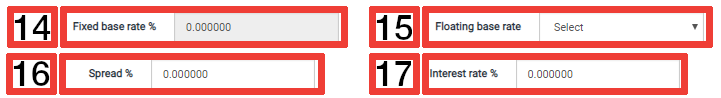

A) Check Fixed Interest checkbox if the loan has a a fixed interest. If the loan has a floating interest leave A unchecked.

14) If A is selected then enter the fixed rate into Fixed base rate %..

15) If A is unchecked the choose relevant floating rate reference rate from the Floating base rate drop down menu.

{info}If the reference rate is correctly defined in the reference rate settings then the system will automatically update your floating rate loans.

16) Enter the Spread %.

17) For Fixed loan the Interest rate %. is calculated as Fixed base rate %. + Spread %.

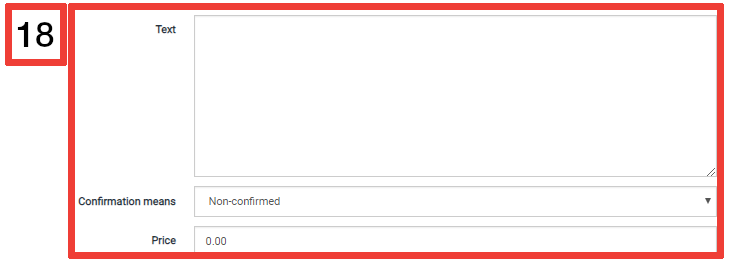

18) Enter additional Text.

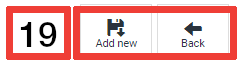

19) Click Add new to save or Back to cancel.

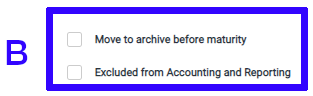

B) The Move to archive before maturity and/or Excluded from Accounting and Reporting checkboxes can be used in special cases such as dummy deals.