About Lease changes

After your lease has started, and after you have already posted the initial starting balances to your balance sheet, you should never make any changes to a lease in the first lease flow view, as this would affect the initial starting balances of the lease.

You can't make any changes in specific row IF you have already made lease change to lease flow.

There are two way to create changes for your lease agreements by importing those using our import spreadsheet or by manually making a change for a single agreement.

EXCEL IMPORT FOR LEASE CHANGES

Click the first ‘Import Lease Changes tab’ in the lease register. Following this step, from the ‘Download sample’, you can get the import excel template that you can use for the import.

In the change import excel the first column A is the existing id for that lease you are going to make a change for. In column B you have a dropdown from where you need to specify the kind of change you are making. This and the rest of the columns are the exact same as explained later in this document on "CREATING CHANGES MANUALLY" on sections 1-11 and Price Increase in Lease Changes. Price increase interval, last payment date are columns similar from lease changes tab in the lease, so price change interval is the number of months, (for last payment date see below in Price Increase in Lease Changes section, it should be in yyyy-mm-dd format). Remember to use for date of change and effective start date first day of month date and to end date last day of month.

You can bring up to 100 lease changes at once. It always recommended to try first with one lease and see that you have all correct with one lease and test to run it in. Then once it is OK then bring the rest. After import it is recommended to always see a couple of leases and make sure that everything went well.

You can bring multiple changes for one agreement in one file. The changes just need to be in chronological order so that the oldest is first and so on. And all changes for one lease need to be next to each other.

If you bring the interest rate for a lease in the excel, do not use any %-sings in the field. So 8 % should be in the excel 8. Don’t forget to check the date formats to make sure they are correct: yyyy-mm-dd.

If you wish to have changes in single payments in change scenarios then you need to do those changes manually to agreements.

CREATING CHANGES MANUALLY

When a change occurs during your lease that has an effect to scope or to the lease term, you need to alter these via the ‘Lease Changes’ tab in the relevant ‘Lease Agreement’.

Once you have given all the information (described below) for the change click "Save" and then the system will adjust your BS values correctly.

First go into the lease you are about to change. Click on (1) Leasing > Register or (2) Leasing.

Click on the edit icon. (pen)

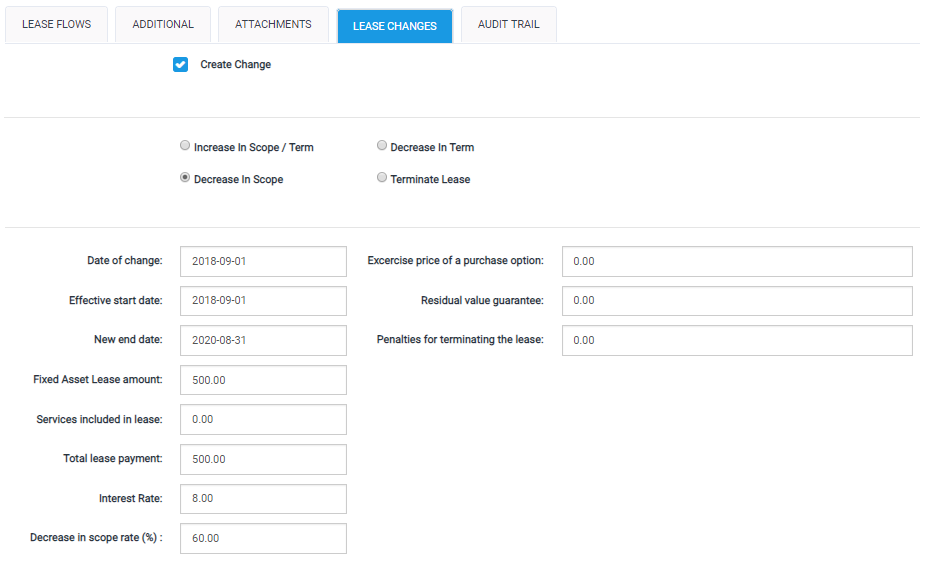

Open up the tab LEASE CHANGES.

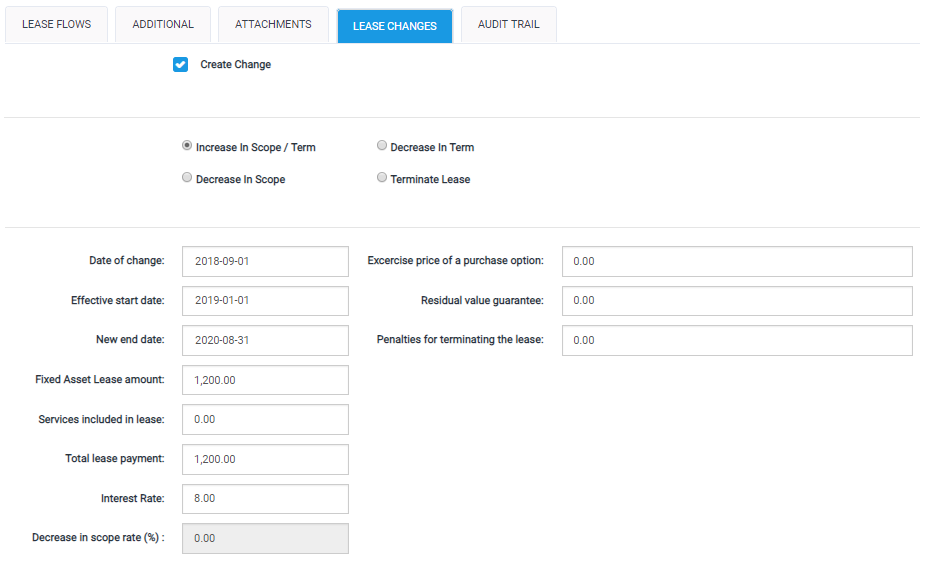

Following this step, you will have to use the view below to make any necessary changes.

1) Date of change is the date of the new agreement. The new values will be calculated for this date. The system requires the data to be the first day of the month.

2) The ‘Effective start date’ is the date when the actual payments will be changed in case any changes have been made. Use first day of month date.

3) The ‘New end date’ should be changed if there is a change to the lease agreement end date. The system requires the date to be the last day of the month here.

4) Enter the ‘Fixed Asset Lease’ amount if there has been a change.

5) Enter the Services included in the lease if there has been a change.

6) The ‘Total lease payment’ is automatic from the ‘Fixed Asset Lease’ amount and will only change if the new lease agreement value changes.

7) Interest Rate will be automatically defined by your ‘Company Settings’. But it can also be changed here if needed.

8) The Decrease in scope rate (%) is for cases where there is a decreasing scope in the lease. So for example, if you are renting a 100 s/m office and you stop using half of it, you’ll make a 50% decrease to your lease. Input 50% and the number should be the amount that you are decreasing the lease by. So, if you make 25% decrease to the lease and 75% will remain, enter 25%.

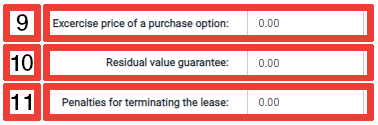

These three fields will have an effect on your ‘Lease Liability’ and your ‘Right-of-Use’ asset:

Exercise price of a purchase option(9), Residual value guarantee(10) and Penalties for terminating the lease(11).

*If you input values here, you need to be certain that you will execute these at the end of your lease term. Your liability amount will show these values at the end of the lease term, which you then need to write off on your Balance Sheet with these payments.

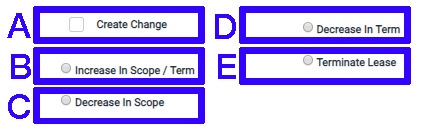

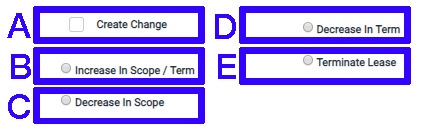

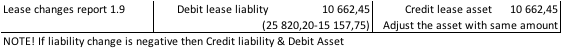

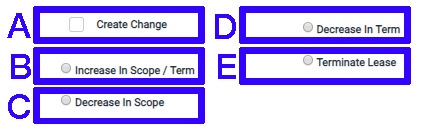

A) ‘Create Change’ must be ticked every time a change is being made.

B) The ‘Increase in Scope / Term’ option must be selected whenever an increase is being applied to the scope or the term of the lease.

C) The ‘Decrease in Scope’ option must be selected whenever a decrease is being applied to the scope of the lease.

D) The ‘Decrease in Term’ must be selected whenever a decrease is being applied to the terms of the lease.

E) The ‘Terminate Lease’ must be selected when you want to terminate a lease immediately.

PRICE INCREASE IN LEASE CHANGES

If there is some price increase mechanism already agreed upon by you, input that from the ‘Lease changes’ view:

First, define the Price increase interval. If, for example, the interval is yearly, put 12.

Then

The Date of the first price increase should be the last day the old price was valid. (e.g. if your last payment with the initial lease payment value is in December 2018, then input here 31.12.2018. Then, the next payment will be with the increased amount).

Input the Negotiated Price Increase Amount.

or

Input the Negotiated Price Increase Percentage.

SINGLE PAYMENT CHANGES

If you have some payment in your lease flow where the payment value is not the same as the generator, input that payment month and value under "Change in single payment" drop down. From there, it is possible to change 5 payments to something else.

After you have given the needed information for the change then click "Save".

LEASE CHANGES IN AUDIT TRAIL

Every change will be saved in the ‘Lease Changes’ window as a separate lease change item. With this table, you can keep on track what type of changes have been made, when, and by whom.

If you make a mistake while creating a change, you can easily go back to delete the latest change. Following this step, you can give it another try.

PRACTICAL CALCULATION EXAMPLES OF DIFFERENT CHANGE SCENARIOS

Using the compound interest rate method.

Increase in ‘Term/Scope’

In all increase situations and price changes due to the index, for example, the changes are done by selecting (B) Increase in Scope / Term and (A) Create Change:

After making all needed changes, press ‘Save’, and you can see your new accounting liability and asset balances (and the new depreciation and interest costs accordingly).

Practical example

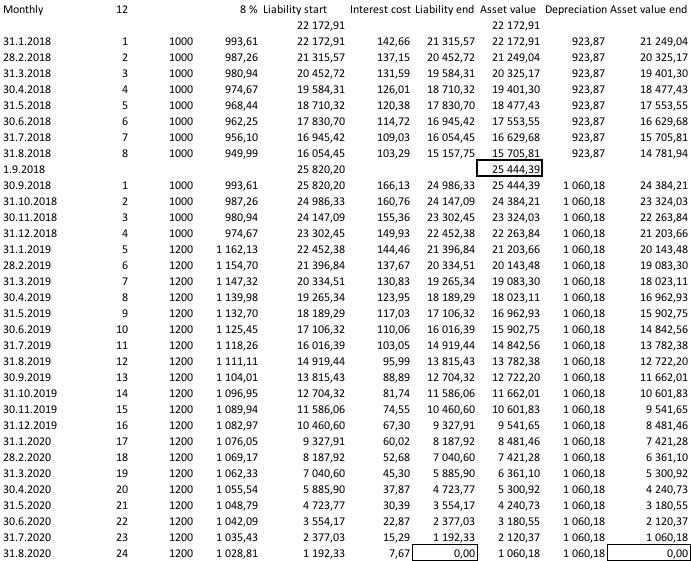

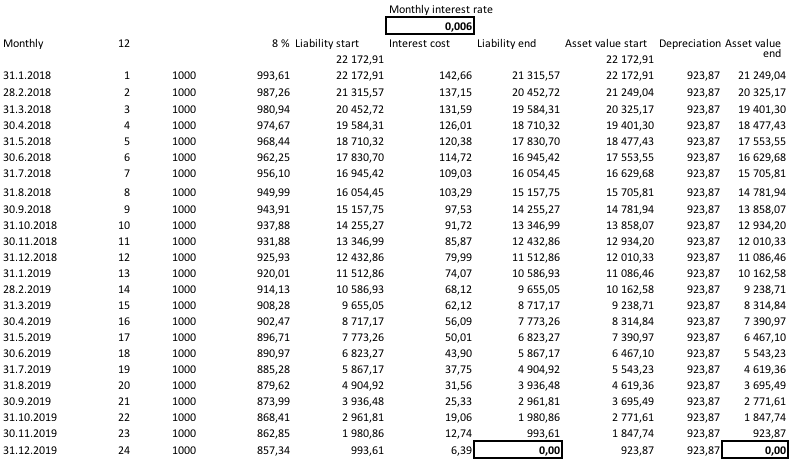

We will start with the Excel calculation method presented below. Let’s assess the situation before the changes:

The company decides to do a lease extension on the 1-9-2018 (until 31-8-2020) and increase the scope by 200/month. See all relevant selections below:

And after the changes:

The accounting shown for the ‘Lease Changes’ report will then be:

Decrease in Scope

You need a Decrease in Scope where both:

- the underlying asset that you are leasing is somehow decreased

- the lease payments also change

Then select the (C) Decrease in Scope function and (A) Create Change.

After making all needed changes, press ‘Save’, and you can see your new accounting liability and asset balances (and the new depreciation and interest costs accordingly).

Practical example

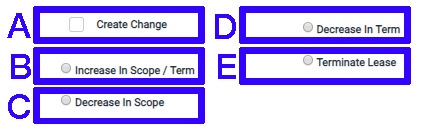

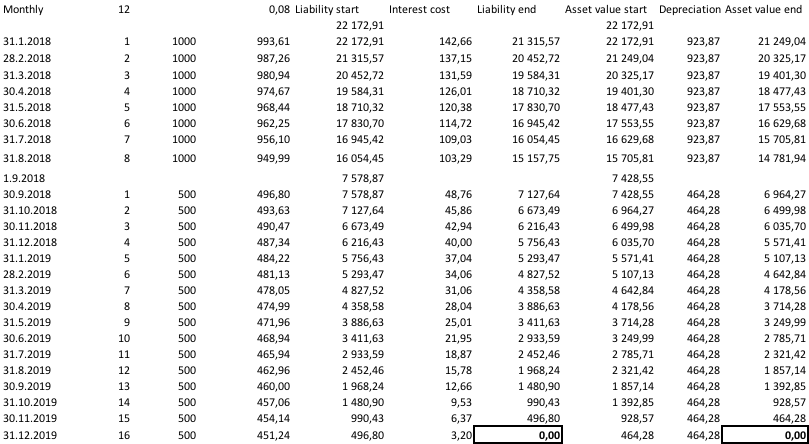

Let’s continue with the Excel calculation method. First, we will assess the situation before the changes:

In this example, the company decreases its current lease by 60% and the lease cost decreases from 1000 to 500. See the relevant selections below:

And after the changes:

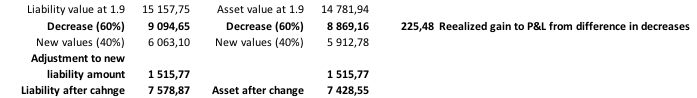

In this example above you will have in the Lease Changes Report:

- 9 094,65 liability,

- 8 869,16 asset

- 225,48 gain to P&L.

You will also have the adjustment row of 1 515,77 to liability and asset to get you to the right liability amount.

Decrease in Term

In a ‘Decrease in Terms’ situation, you are making your lease term shorter.

Then, select the (C) Decrease in Term function and (A) Create Change.

After making all needed changes, press ‘Save’, and you can see your new accounting liability and asset balances (and the new depreciation and interest costs accordingly).

Practical example

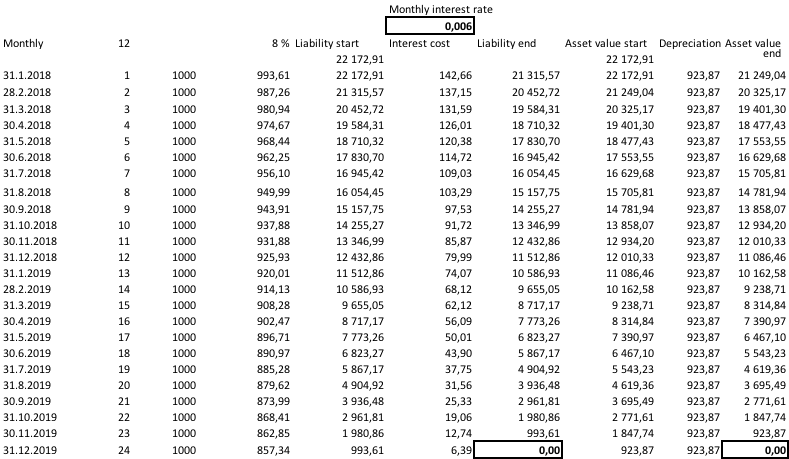

Once again, we will continue with the Excel calculation method. First, the situation before the changes:

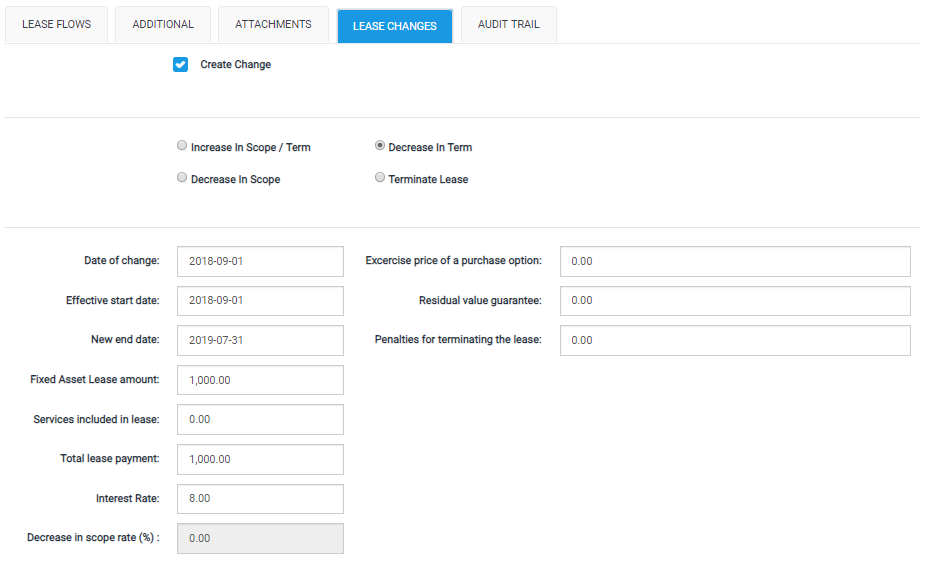

In this case, we have agreed with the lessor on 1-9-2018 that the new end date will be 31-7-2019 (always use the last day of the month) instead of 31-12-2019. See the relevant selections below:

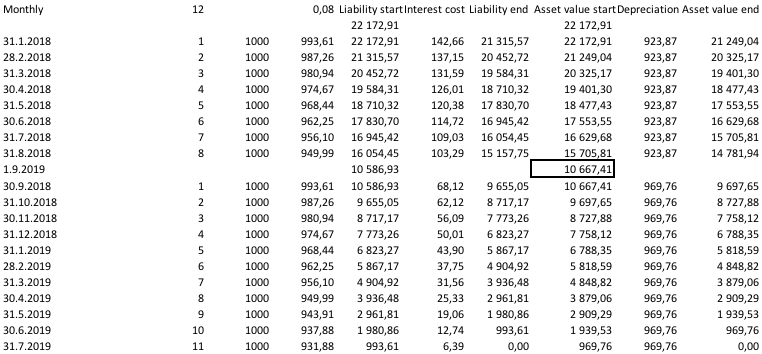

Situation after the change:

In this example you will have in the Lease Changes Report:

- Change in liability -4 570,81,

- Change in asset -4 644,02

- Realised P&L -73,21

Terminate Lease

If you need to end your lease agreement immediately, you should select this tab. Then, just select the ‘Date of Change’ from the calendar during the current month. Both Liability and Right-of-Use Asset will be reversed to zero in the Lease Changes report and the difference will be shown in the Realised result, in the P&L column.

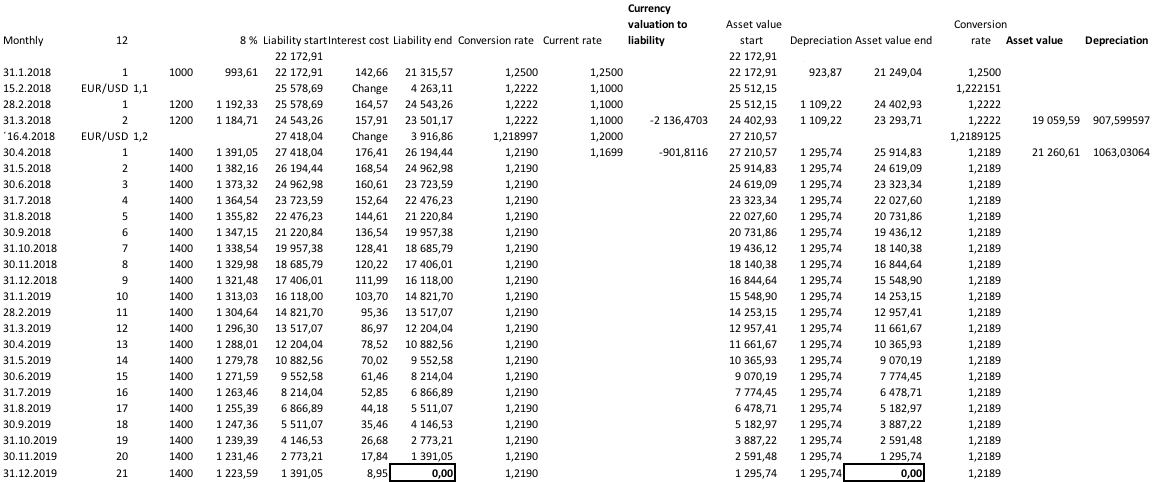

Currency Conversions in Change Situations

So the calculation for example to liability conversion rate to 16-4-2018 is

+27 418,04/((23 501,17/1,2222)+(3 916,86/1,2))=1,218997

Changing Lease payments per year

1.) The system allows for change only if no previous change has been made to the contract. In order to change the payments per year the user needs to change the payments per year and then add a lease change.

2.) When terminating a contract the remaining payments currently go to the period after the last lease flow. If you wish to have all on the same period then you need to use the lease change "Decrease in term" option.